Tax Season 2024 (Tax Year 2023)

SBNT TAX NEWS

Child Tax Credit

The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return.

Child Tax Credit Questions Answered

What is Child Tax Credit?

Child Tax Credit is a credit for individuals who claim a child as a dependent if the child meets certain conditions.

How Do I Get The Full Child Tax Credit?

To get the full child tax credit of up to $2,000 per child, you must file your 2023 federal tax return and claim your qualified dependent.

*New 2023 Child Tax Credit Increase Pending

Updates will be provided as it becomes available.

Top 5 Reasons Most People Owe the IRS

POPULAR TAX NEWS

1. Form W4 not completed correctly.

What is a form W4?

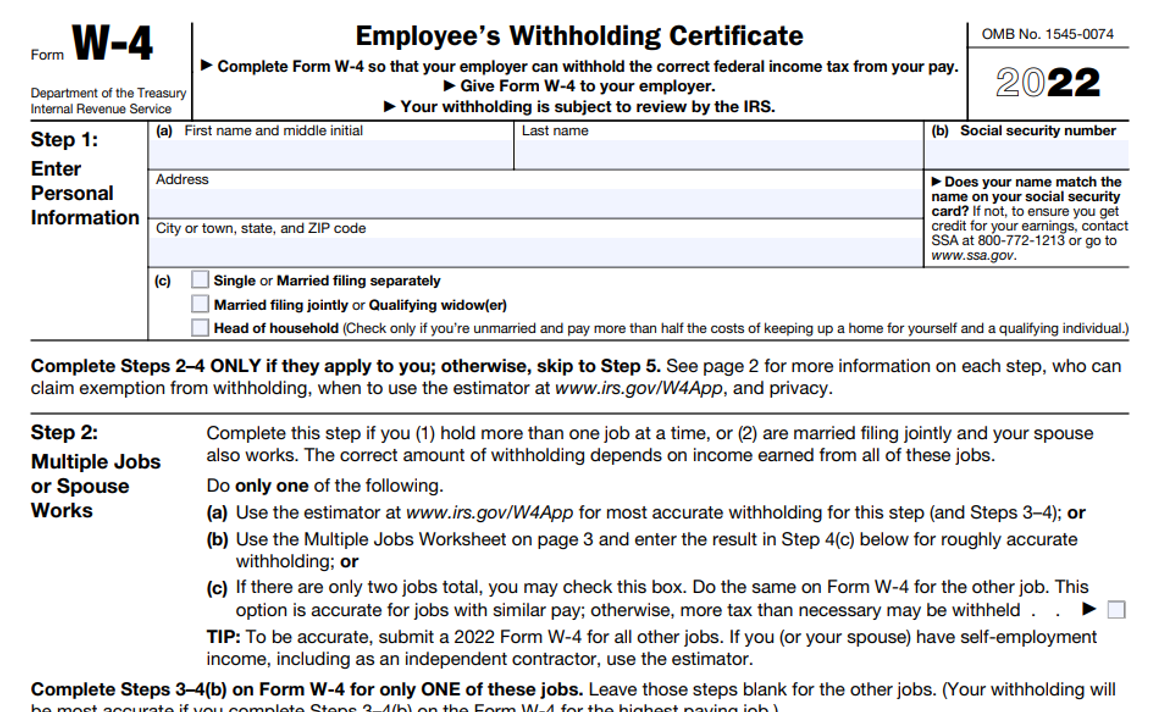

A Form W-4 also called Employee’s Withholding Certificate is an Internal Revenue Service tax (IRS) form that is completed by an employee to inform their employer of how much money to withhold from each paycheck for federal income taxes.

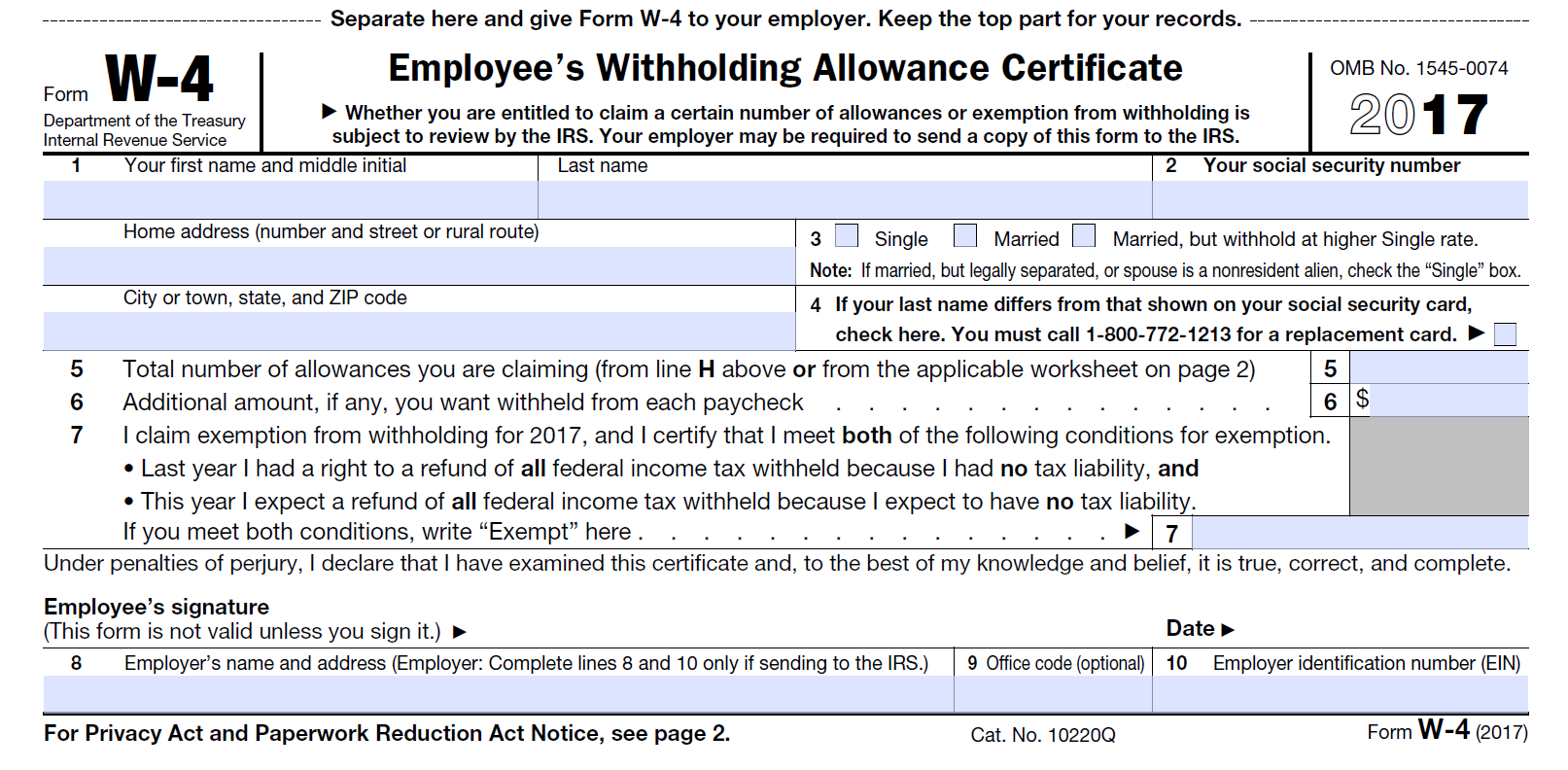

Over the past several years the form W4 has gone through several changes. Most people do not know how to properly complete the form W4, and some are stuck on the old tax system where they add the maximum amount of dependents on their W4 to reduce the amount of federal tax that is withheld from each paycheck.

Example (Old W4): A single parent with three children would add 1 for themselves and 3 for their dependents making the total number of exemptions 4.

Example (Current W4-2022): A single parent with three children would Multiply the number of qualifying children under age 17 by $2,000 or

Multiply the number of other dependents by $500 and enter the total dollar amount on line 3.

Then there are the individuals that are almost certain that they will receive a tax refund, so they flat out exempt themselves from federal tax withholdings. Let’s rewind a bit to personal exemptions.

What is a personal exemption? A Personal exemption is the amount of money that each taxpayer could deduct for themselves and for each of their dependents on their tax return.

For example, in 2017 the personal exemption amount was $4,050 for all taxpayers. The amount of exemptions you could claim was not based on your expenses. The personal exemption was used to reduce your taxable income, but some individuals were not eligible to claim the personal exemption especially if someone could claim them as a dependent. There was also a phaseout based on the taxpayer’s income which they would either receive a reduced exemption or no exemption at all. Nevertheless, the personal exemption was an effective way to reduce your tax bill. Fast forward to 2018, the deduction for personal exemptions was suspended (reduced to $0) for tax years 2018 through 2025. That means you cannot claim any personal exemptions on your 2018 taxes or beyond.

With personal exemptions gone taxpayers must be very careful when completing form W4, especially for those who have more than one job. Taxpayers must also be very careful not to calculate credits for dependents that will that be claimed on their federal tax return. In essence, your Form W4 can make or break you when its time to file your federal tax return.

Tips for completing Form W4

- Read the instructions to the form W4 very carefully and follow each step as directed.

- Do not overstate/understate your income because this will also have a negative impact on your tax return.

- Be sure to choose the right filing status, if you are single (legally separated, divorced, never married, or considered single for tax purposes) please choose single as your status.

- Remember that for tax purposes the head of household filing status is used by individuals who will be claiming children on their tax return as dependents.

- A single person with no children should not be choosing head of household as a filing status.

- Update your form W4 as your household situation changes. Common changes include marriage, birth of a child, adoption of a child, and divorce. Most parents who have been working for an employer for several years never update their W4 even after their children moved out of their home and can no longer be claimed as a dependent.

Remember when in doubt contact a tax professional for further assistance when completing your form W4. At SBNT we offer tax consultations to assist individuals with everyday federal tax questions. Click here to schedule and appointment with us today.

We have IRS experienced Tax Professionals Available Everyday

Need Help Filing Your Taxes?

Knowledge is the key to success

We specialize in the following:

We work hard to get you the best results.

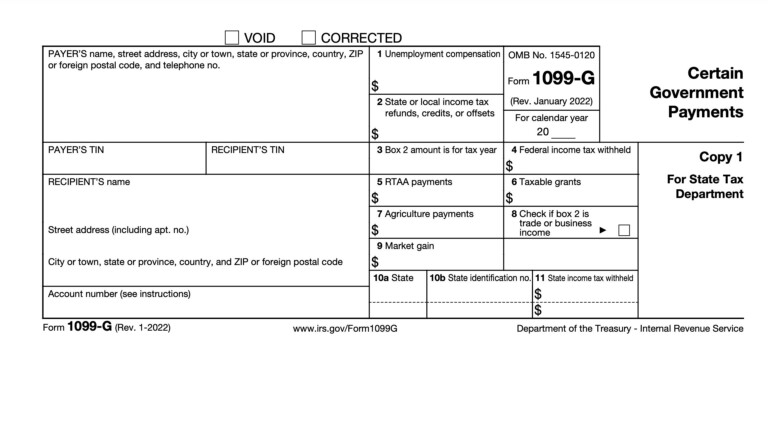

DO NOT EXPECT A REFUND ON UNEMPLOYMENT BENEFITS THIS TAX SEASON

To avoid owing a tax balance it is best practice to have federal taxes withheld from your unemployment benefits. Any overpayment in federal taxes may result in a refund when you file your tax return. For more information on the unemployment tax exclusion click here.

The American Rescue Plan Act, waived federal taxes on up to $10,200 of unemployment benefits, per person, for benefits received in 2020.

For tax year 2021 (the current tax season) Congress has not extended this law or passed a new law offering a tax break on unemployment benefits received in 2021.

Taxpayers who did not have federal taxes withheld from their unemployment benefits may be faced with a tax bill or little to no refund when they file their 2021 tax return this season.

Bigger is Always Better When it Comes to your tax refund

over 17 years of Tax experience